"The best time to plant a tree was 20 years ago. The second best time is today." -Chinese proverb

To own or not to own... That is the question. The decision of whether to rent or not is an ongoing question every individual asks themselves. Choosing where your family is going to live is a major decision that no one takes lightly. Finances, location, size, and quality are just a few of the major factors that go into determining the best fit.

Many people feel boxed into renting a house or apartment because they believe they cannot afford to purchase a house. However, because the information is more readily available, people are realizing that purchasing a house can actually save them money in comparison to renting. Let's take a peek and get some quick insight on one of the most important factors to keep in mind, is that when you are renting your home you do not have the security of ownership.

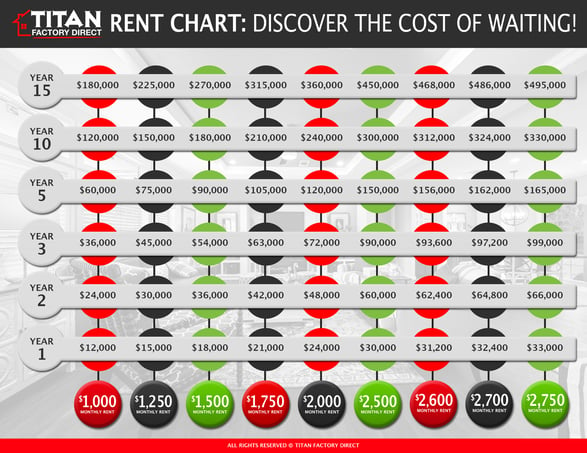

Many have turned to rent because they feel that they're saving money, however in the long run, they are spending tens of thousands, sometimes hundreds of thousands, that they do not see anything for in return. Check out the chart below to see how much is spent over the years when you decide to rent, the amounts are astounding!

Owning a home has many financial benefits. Substantial tax benefits and a $4,500 deductible interest for the first five years also give owning an advantage over renting. Interest rates are currently the lowest they have been in decades, making it a prime time for purchasing a home.

Costs for lumber, drywall, and fuel are all factored into the overall price of the home. As these costs rise so does the price of the home. The exact same home could be thousands of dollars more in five years, simply because of inflation on building supplies. Consider that a home can cost $100,000 today. If interest rates go up just 1% that increases your total cost on the home by $20,752 over the term of 30 years. If material costs increase 4% the cost of the home goes up $4,000. Now add in the cost of renting for two years you are looking at a total of $45,152. That is the cost of sitting on the fence for two years, considering a home. That $100,000 home's cost went to 145,152 without adding anything to it.

Before you decide that renting is the best option for you, get all the information! You no longer have to just take someone's word for it. A lot of times people are so intimidated by financing that they never check to see if they would be approved. We have plenty of customers that are pleasantly surprised by the rates they are approved for. It is simply a matter of checking! Oftentimes, the monthly payments on a 1500-square-foot house is less than renting a 700-square-foot apartment, so why wouldn't you want to find out if that is an option for your family?

Leave a comment